9.03am EDT

09:03

Back on sanctions…

The EU has imposed sanctions on the boss of anti-war protester Marina Ovsyannikova at Russia’s Channel One, along with Chelsea owner Roman Abramovich for his “very good relations with Vladimir Putin”.

Konstantin Ernst, the chief executive of the state-controlled TV channel, and Chelsea football club’s owner are among 15 individuals newly targeted by the EU.

The EU is also banning investments in Russia’s energy sector, as well as exports of finished steel products and most luxury goods, such as precious stones, clothes and carpets, over the value of €300 (£252) and cars worth more than €50,000.

There is also a complete transaction ban with nine Russian state-owned enterprises and the EU has prohibited the rating of the country and its companies by credit rating agencies.

Here’s the full story, by Daniel Boffey and Jennifer Rankin:

8.55am EDT

08:55

US crude oil has also dropped, with a barrel of West Texas Intermediate falling as low as $93.54, before a small rebound.

That’s the lowest since late February, down from $103 a barrel last night – and as high as $130/barrel a week ago.

Faizan Hayat Khan

(@FaizanHayat13)

WTI crude Oil goes back to the 90s. https://t.co/mqRanA8Xlm pic.twitter.com/fOuxG6l0tw

March 15, 2022

Patrick De Haan ⛽️📊

(@GasBuddyGuy)

Oil collapsing again this morning:

WTI $94, down $8

RBOB down 22c/gal

It’s only time before we sink back under $4/gal average as long as these levels hold.

March 15, 2022

8.33am EDT

08:33

Hopes of a breakthrough in the Iran nuclear talks are also pushing oil down.

Russia, which has been meeting with Iran today, has indicated it is in favour of the nuclear deal resuming as soon as possible, according to Reuters.

Russian foreign minister Sergei Lavrov has told a news conference that Moscow has received written guarantees that its cooperation with Iran will not be impacted by Westen sanctions over the Ukraine war.

This has lifted optimism that the 2015 nuclear deal could be revived, meaning sanctions on Iranian oil would be lifted, boosting supplies.

Talks were put on hold last week, after Moscow demanded that Western sanctions over Ukraine will “not in any way damage our right to free and full trade, economic and investment cooperation and military-technical cooperation” with Iran, if the deal was agreed.

Reuters says:

Russian Foreign Minister Sergei Lavrov on Tuesday said US suggestions that Moscow was blocking efforts to revive the Iran nuclear deal were untrue, following talks with his Iranian counterpart Hossein Amirabdollahian in Moscow.

Lavrov said Russia had received written assurances from Washington that sanctions against Moscow over Ukraine would not hinder cooperation within the framework of the deal, which lifted sanctions on Tehran in return for curbs on its nuclear programme.

Golnar Motevalli

(@golnarM)

An important statement from Lavrov suggesting that Russia’s demands/concerns over the impact of U.S. sanctions related to Ukraine war, on its future work with Iran (on trade and nuclear industry) have been resolved. Indicates that the Iran talks may resume soon. https://t.co/73EnkSJr86

March 15, 2022

Investing.com

(@Investingcom)

*RUSSIAN FOREIGN MINISTER LAVROV SAYS RUSSIA SEEKS RESUMPTION OF NUCLEAR DEAL ON IRAN AS SOON AS POSSIBLE

*LAVROV SAYS BOTH OIL CONSUMERS AND SUPPLIERS WILL FEEL RETURN OF IRANIAN OIL DELIVERIES TO THE MARKET#OOTT 🇷🇺🇮🇷🌎🌍🌏

March 15, 2022

The talks were paused last week, after Moscow has insisted Washington pledge not to impose sanctions on any trade between Russia and Iran once an agreement is signed.

Iran pumped 2.4m barrels per day on average in 2021, and has said it could eventually increase output to 3.8m bpd if sanctions are lifted.

Updated

at 8.33am EDT

7.55am EDT

07:55

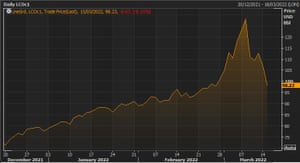

Brent crude falls below $100

Brent crude has fallen back below the $100 per barrel mark for the first time since the start of March.

Hope of progress in the Russia-Ukraine peace talks, and concerns that rising Covid cases in China will hit its recovery, have pushed oil prices to a two-week low.

Brent has now tumbled 8% to around $98 per barrel:

The Brent crude oil price over the last three months Photograph: Refinitiv

The surge in Covid-19 cases in China to a two-year high is raising fears of more lockdowns, hitting demand for energy at its factories.

Stephen Innes, managing partner at SPI Asset Management, explains:

Though global demand is widely expected to return to pre-covid levels this year, China is an important enough part of the worldwide demand picture that a new wave of lockdowns could prolong the recovery cycle.

Ceasefire talks between Russia and Ukraine are also easing fears of further supply disruptions.

Toshitaka Tazawa, an analyst at Fujitomi Securities, says:

“Expectations of positive developments in the Russia-Ukraine ceasefire talks bolstered hopes to ease tightness in the global crude market.

“Fresh lockdowns to curb the COVID-19 pandemic in China also raised concerns over slower demand.”

Brent hit a 14-year high of $139 at the start of last week, as the US pushed allies for a ban on Russian oil imports.

But crude prices have eased back since, despite president Biden announcing a US ban, with Europe resisting pressure to boycott Russian energy imports now.

Kathy Jones

(@KathyJones)

Crude oil prices have reversed most of the spike since the start of the Russia-Ukraine war pic.twitter.com/zDTUCTEthj

March 15, 2022

Liz Ann Sonders

(@LizAnnSonders)

Brent crude extending drop from its peak to nearly -23% pic.twitter.com/3QmbNAHicO

March 15, 2022

7.24am EDT

07:24

UK fuel prices at new highs

UK fuel prices have hit new highs despite a slump in wholesale costs over the last week.

Figures from data firm Experian Catalist show the average cost of a litre of petrol at UK forecourts on Monday was 163.7p, up from 150p at the end of February.

This takes the cost of filling a typical 55-litre family car with petrol above £90 for the first time.

The average cost of a litre of diesel on Monday was a record 173.7p.

Yesterday, MPs heard that prices could rise by another 50% due to sanctions on Russia, which exports around 5 million barrels of crude per day.

Oil prices surged after Russia’s invasion of Ukraine but declined in recent days, leading to a cut in wholesale costs for fuel retailers.

RAC fuel spokesman Simon Williams says petrol retailers need to pass on the impact of falling crude prices:

“Drivers should be encouraged by oil and wholesale prices dropping again yesterday.

“It’s now vital that the biggest retailers who buy fuel most often start to reflect these reductions at the pumps to give drivers a much-needed break from the pain of constantly rising prices.”

7.16am EDT

07:16

German recession looms after record slump in investor morale

Over in Germany, investor confidence has plunged at a record rate as the Russia-Ukraine war pushes Europe’s largest economy towards recession.

Economic sentiment tumbled by the most since the ZEW economic research institute began tracking it in December 1991.

It fell from 54.3 in February to -39.3 points this month, as the conflict and sanctions imposed on Russia threaten the recovery.

ZEW_en

(@zew_en)

#ZEWEconomicSentiment: Biggest drop in expectations since survey start. ZEW Index stands at -39.3 Points. „The war in Ukraine & the sanctions against Russia are significantly dampening the economic outlook for Germany,“ says #ZEW president @AchimWambach https://t.co/zQ5RtMtXU3 pic.twitter.com/oFPmpfHsD7

March 15, 2022

A measure of current economic conditions also slumped (to -21.4 from -8.1)

President Achim Wambach said that fears of surging inflation had also risen, following the jump in oil and commodity prices.

“A recession is becoming more and more likely. The war in Ukraine and the sanctions against Russia are significantly dampening the economic outlook for Germany.”

The collapsing economic expectations are accompanied by an extreme rise in inflation expectations. The experts therefore expect stagflation in the coming months.

The worsened outlook affects practically all sectors of the German economy, but especially the energy-intensive sectors and the financial sector.

Trading Economics

(@tEconomics)

ZEW Economic Sentiment Index in Germany decreased to -39.30 points in March from 54.30 points in February of 2022. https://t.co/2TOP8G26fS pic.twitter.com/MNcsnLGp95

March 15, 2022

7.14am EDT

07:14

UK cuts off export finance support to Russia and Belarus

The UK is also cutting off all export finance support to Russia and Belarus, a move which will also hit trade from Britain to both countries.

Britain will no longer issue any new guarantees, loans or insurance for exports to Russia and Belarus.

Export finance support helps companies win contracts, fulfil them, and get insurance in case their buyer defaults.

UK Export Finance (UKEF), the UK’s export credit agency, says it is still supporting trade with Ukraine with £3.5bn of capacity available “as part of its continuing and unwavering alliance”.

This backing would help UK exporters and Ukrainian buyers access the finance they need to trade commercially.

Without government export credit support, any financial backing from the private sector to the region is “virtually impossible”, UKEF says.

International Trade Secretary Anne-Marie Trevelyan says economic sanctions are working:

We are tightening the screws on Russia to ensure they feel real consequences for their illegal military invasion.

At the same time, we are doing everything we can to ensure Ukraine remains open to the world. We have signed an international treaty so that UK supplies can reach Ukraine and strengthen their defences, and UK Export Finance – our first-class export credit agency – is supporting them with this.

Labour MP Emily Thornberry, shadow Attorney General, says the government should have acted faster:

Emily Thornberry

(@EmilyThornberry)

I started tabling parliamentary questions on 28th February asking why UK Export Finance was still offering support on exports to Russia. I’m glad the government has now finally ended that support, but why does everything take them so long? https://t.co/l40zXNKHhR

March 15, 2022

The Department for International Trade also reports that fifty-four licences for exports to Russia have been voluntarily surrendered by UK businesses, while 33 new licence applications to export items to support Ukraine have been submitted.

6.40am EDT

06:40

British car dealership Inchcape is also leaving Russia, having concluded that it is “no longer tenable” to operate there.

Inchcape, which operates in around 40 countries, told shareholders:

In light of the current circumstances, we have concluded that the Group’s ownership of its business interests in Russia is no longer tenable. Therefore, working in conjunction with our OEM partners, we have initiated a process to transition our Russian business.

We intend to do so in full compliance with international and local regulations and with the aim of safeguarding the continuing employment of our colleagues.

Russia provided around 10%, or £750m, of Inchcape’s sales last year and 5% of operating profits in the last five years.

6.33am EDT

06:33

Photograph: Pavlo Gonchar/SOPA Images/REX/Shutterstock

Cigarette maker Imperial Brands is quitting Russia, joining the swelling ranks of Western companies exiting due to the Ukraine war.

Imperial said this morning it has begun negotiations with a local third party to transfer its Russian assets and operations, saying this was the best option for its 1,000 staff in Russia.

We believe that, in the current circumstances, an orderly transfer of our business as a going concern would be in the best interests of our Russian colleagues.

We employ 1,000 people in Russia in our sales and marketing operations and in our factory in Volgograd – and their safety and wellbeing is our key priority in this process. We will also continue to pay their salaries until any transfer is concluded.

Last week, Imperial, the maker of Winston and Davidoff cigarettes, suspended all operations in Russia.

On Friday, rival British American Tobacco announced it would pull out of Russia, having initially deciding to keep selling products.

6.18am EDT

06:18

Here’s our story on the latest UK economic sanctions on Russia:

5.59am EDT

05:59

UK hits Russian goods with new tariffs and bans luxury exports

Photograph: Maxim Shemetov/Reuters

The UK is imposing new tariffs on some Russian imports, including vodka, and announcing a ban on exports of some high-end luxury goods to Russia.

A new 35% tariff will be imposed on a range of goods imported from Russia, on top of existing tariffs, in the latest round of economic sanctions over the invasion of Ukraine.

The tariffs will affect £900m of imports, while the ban on luxury goods is likely to apply to luxury vehicles, high-end fashion and works of art.

Products affected by the new tariffs on Russian imports are:

- Iron, steel, fertilisers, wood, tyres, railway containers, cement, copper, aluminium, silver, lead, iron ore, residue/food waste products, beverages, spirits and vinegar (this includes vodka), glass and glassware, cereals, oil seeds, paper and paperboard, machinery, works of art, antiques, fur skins and artificial fur, ships and white fish

The government says the products were chosen to inflict maximum damage on the Russian economy while minimising the impact on the UK:

It adds:

The export ban will come into force shortly and will make sure oligarchs and other members of the elite, who have grown rich under President Putin’s reign and support his illegal invasion, are deprived of access to luxury goods.

The UK is also denying Russia and Belarus access to Most Favoured Nation tariff for hundreds of their exports, which will remove key benefits of WTO membership.

Chancellor of the Exchequer Rishi Sunak said:

Our new tariffs will further isolate the Russian economy from global trade, ensuring it does not benefit from the rules-based international system it does not respect.

These tariffs build on the UK’s existing work to starve Russia’s access to international finance, sanction Putin’s cronies and exert maximum economic pressure on his regime.

Updated

at 6.39am EDT